Exploring the Trading Landscape in India: The Appeal of Reliance Industries Ltd and Beyond

"Exploring the Trading Landscape in India: The Appeal of Reliance Industries Ltd and Beyond"

Introduction:

In India's dynamic financial landscape, choosing the right company for trading can be a pivotal decision that shapes an investor's journey. While there are numerous options available, one company that has captured the attention of many is Reliance Industries Ltd. In this blog, we'll delve into the factors that make Reliance Industries an attractive choice for trading, as well as explore other noteworthy options in the Indian trading arena.

**Reliance Industries Ltd: The Attraction**

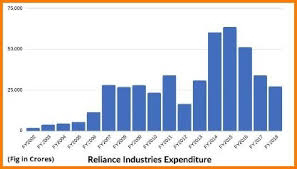

Reliance Industries Ltd (RIL) stands as one of India's largest conglomerates, with its influence spanning across sectors such as petrochemicals, refining, telecommunications, retail, and more. Several factors contribute to its appeal among traders:

1. **Diversification:** RIL's diversified portfolio offers exposure to multiple sectors, allowing investors to tap into various segments of the Indian economy. This diversification can help mitigate risks associated with relying on a single industry.

2. **Innovation and Growth:** RIL's reputation for innovation and consistent growth has garnered the attention of traders seeking opportunities in companies with a strong upward trajectory. Its expansion into digital services through Jio Infocomm has been particularly noteworthy.

3. **Market Leadership:** RIL's dominant position in industries such as petrochemicals and refining gives it a competitive edge. This market leadership can translate into consistent revenues and attract investors seeking stability.

4. **Reliance Jio:** The company's telecommunications arm, Reliance Jio, disrupted the industry by offering affordable data plans and rapidly gaining market share. This success has positioned RIL as a major player in the digital revolution.

5. **Strategic Partnerships:** Reliance Industries has formed strategic partnerships with global giants like Facebook and Google, enhancing its presence in the digital space and signaling confidence from international investors.

**Beyond Reliance: Exploring Other Trading Options**

While Reliance Industries Ltd is an enticing choice, the Indian trading landscape offers a variety of opportunities. Some other notable companies that investors often consider for trading include:

1. **Tata Consultancy Services (TCS):** TCS is one of India's largest IT services companies, with a global footprint. Its consistent performance and strong client base make it a preferred choice for investors.

2. **Infosys:** Another major player in the IT sector, Infosys is known for its technological expertise and global reach. It has attracted investors seeking exposure to the software and services industry.

3. **HDFC Bank:** As one of India's leading private sector banks, HDFC Bank boasts a strong financial position, a widespread branch network, and consistent growth, making it an appealing choice for those interested in the banking sector.

4. **ICICI Bank:** ICICI Bank is another prominent player in the Indian banking sector, offering a range of financial products and services. Its extensive reach and diverse offerings make it a favorite among traders.

5. **Adani Group Companies:** Companies under the Adani Group umbrella, such as Adani Ports, Adani Green Energy, and Adani Enterprises, have attracted attention due to their involvement in sectors like infrastructure, energy, and logistics.

Conclusion:

While Reliance Industries Ltd holds a prominent place in the Indian trading arena, it's important to note that the best trading company varies based on individual goals, risk tolerance, and investment strategies. Traders should conduct thorough research, analyze financial data, and consider market trends before making their decisions. Whether choosing RIL or exploring other companies, a well-informed approach is key to achieving success in the complex world of trading in India.

Comments

Post a Comment